Types of Investment

If you are considering investing, think about getting independent financial advice.

Our guide to investing can help you if you are unsure where to start.

| Traditional Investments Types | Alternative Investment Types |

|---|---|

| Shares | Structured Products |

| Government and corporate bonds | Crowdfunding |

| Tracker bonds | Cryptocurrencies |

| Property | Binary options |

| Unit-linked funds | Contracts for Difference |

Shares

What are shares and how do they work?

A share is a small part of a company that you can buy for a set price. Share prices can move up or down in value, depending on the performance of the stock market, investor sentiment and the current and expected future profitability of the company. When you buy shares, you become a shareholder in that company. You can own shares in two ways:

- By yourself and become a shareholder in the company or

- Through a collective investment fund where your money is pooled with other people’s. Often your money is also invested in other assets, like cash, property or bonds.

How do I earn money from investing in shares?

The idea of buying shares is to keep them for a while in order to make money. The two main ways of earning money through shares is:

- If the company grows and becomes more valuable, the share is worth more – so your investment is worth more too.

- Some shares pay you part of the company’s profits each year, called a dividend.

How and where do I invest in shares?

Top Tip

Make sure the provider you choose is regulated by the Central Bank. Check here

By yourself

If you want to buy and sell shares by yourself you can invest through:

- a stockbroker in an investment firm

- an investment broker

- a financial adviser

- a bank

- online trading apps

Through a collective investment fund

If you want to invest in shares through a collective investment fund where your money is pooled with other people, you can invest through:

- a collective fund manager

- a stockbroker

- an investment broker

- a financial adviser

- a bank

Is investing in shares right for me?

Click here for a list of questions to ask your adviser and things to consider before investing in shares.

Pros and cons of investing in shares

Pros

- Potential for good returns over the medium to long term.

- Some shares pay dividends, which can provide you with extra income (especially if share prices drop).

- You can manage the risk by investing in shares in difference sectors or countries.

Cons

- Stock prices can rise and fall dramatically.

- There is no guaranteed return.

- Holding shares in just one company is very high risk. You should consider spreading the risk by buying shares in a number of companies or through a collective investment fund.

Is my money protected? Am I covered under the Investor Compensation Scheme or the Deposit Guarantee Scheme?

Shares are covered under the Investment Compensation Scheme (ICS) up to a limited amount. The ICS only pays compensation in specific circumstances and you are not guaranteed to get compensation for all losses. Read more here and see if you would be eligible to make a claim.

Government and corporate bonds

What are bonds and how do they work?

When you buy a bond, you are lending money to the issuer of the bond (which is usually a government or a company), and in return, the issuer will agree to pay you back the loan, with interest, (also known as the coupon) at an agreed date in the future.

Once you have been issued with a bond you can buy and sell it on the stock market.

You can buy bonds in two ways:

- by buying an individual bond issued by a government or company or

- through a collective investment fund where your money is pooled with other people’s and invested in a wide spread of different bonds.

How do I earn money from investing in bonds?

You can earn money from bonds in two ways:

- The issuer of the bond will pay you a rate of interest (known as the coupon). This is usually paid every year.

- The issuer of the bond will also repay you the face value of the bond at an agreed date in the future. Depending on the type of bond bought the value guaranteed may be less than 100%. (See tracker bonds below).

Some bonds may also link to the rate of inflation, these are known as index linked or inflation linked bonds.

Example:

If you buy a 10-year bond with a face value of €10,000 and an annual coupon of 5%, you would receive:

- €500 interest every year for the 10 years, and

- at the end of the 10 years when the bond matures you will receive the face value of the bond back i.e. €10,000 – as long as you have not sold the bond.

How and where do I invest in bonds?

Government bonds:

Did you know:

The Central Bank of Ireland is responsible for maintaining the Register of Irish Government Bonds and Treasury Bills on behalf of the National Treasury Management Agency (NTMA). Visit the Central Bank’s FAQs here.

Irish Government bonds are issued by the National Treasury Management Agency (NTMA) and can be bought through listed stockbrokers known as ‘Primary Dealers’. The full list of Primary Dealers is available on the NTMA’s website.

Corporate bonds

If you want to buy corporate bonds you can invest through:

- a stockbroker in an investment firm

- an investment broker

- a financial adviser

Is investing in bonds right for me?

Click here for a list of questions to ask your adviser and things to consider before investing in bonds.

Pros and cons of investing in bonds

Pros

- regular income and possible capital growth

- access to funds quite easily for government bonds

- lower risk, in particular government bonds

Cons

- capital growth can be subject to interest rate changes

- high minimum investment may be needed

- inflation can reduce the return you get if the bond is not index linked

Is my money protected? Am I covered under the Investor Compensation Scheme or the Deposit Guarantee Scheme?

Bonds are generally not protected under the Investment Compensation Scheme (ICS), however if you invested indirectly in bonds, for example through a collective investment fund, part of your investment could be covered. The ICS only pays compensation in specific circumstances and you are not guaranteed to get compensation for all losses. Read more here and see if you would be eligible to make a claim.

Tracker Bonds

What are tracker bonds and how do they work?

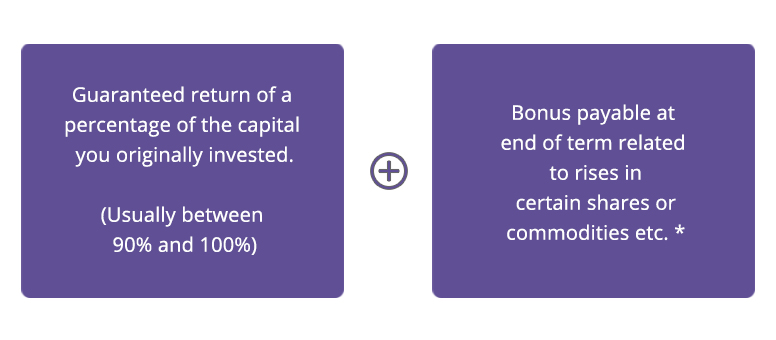

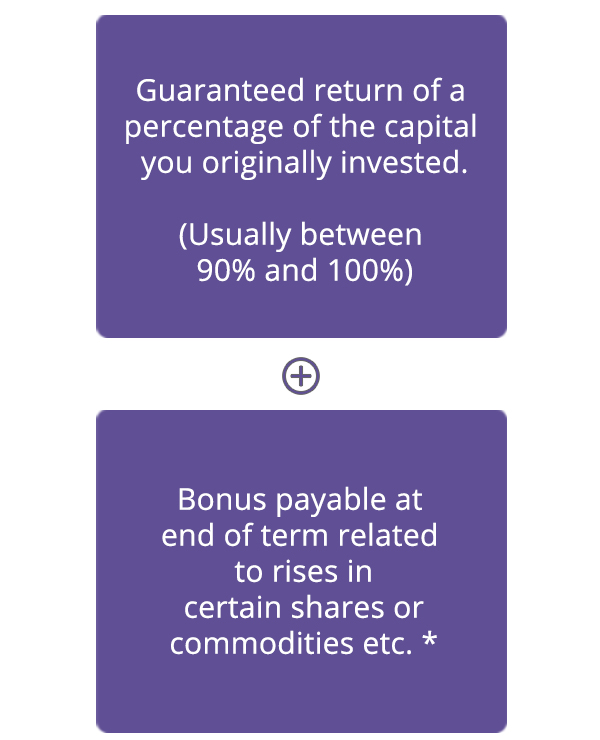

A tracker bond is a fixed term deposit account that you put your money into for a specified length of time (usually between three and six years). During this specified length of time you will have no access to your funds. However, these investments offer a high level of capital guarantee (usually between 90% and 100%) and if the fund performs well you will also receive a bonus or interest payment at the end of the term.

There are two main types of tracker bonds – life insurance tracker bonds and deposit tracker bonds.

How do I earn money from investing in tracker bonds?

You can earn money at the end of the term by receiving a:

* If the chosen shares or commodities do not rise over the period, there may be no bonus payable when the bond matures.

How and where do I invest in tracker bonds?

Top Tip

Make sure the provider you choose is regulated by the Central Bank of Ireland. Check here

You can invest in tracker bonds through:

- a life insurance company

- a bank

- an investment broker

- a financial adviser

Is investing in tracker bonds right for me?

Click here for a list of questions to ask your adviser and things to consider before investing in bonds.

Pros and cons of investing in tracker bonds

Pros

- opportunity to participate in potentially high risk/high return assets such as equities, with reduced risk

- high level of capital guarantee

- potential to earn a bonus or interest if the funds perform well

Cons

- no access to funds during term

- may be a high minimum investment needed

- you may get back less than the original amount invested if the capital is not 100% guaranteed

Is my money protected? Am I covered under the Investor Compensation Scheme or the Deposit Guarantee Scheme?

The deposit element of a tracker bond is covered under the Deposit Guarantee Scheme up to €100,000. Click here for more information.

Property

What is an investment property and how does it work?

This is where you use your money to invest in something tangible, a property. You can invest in either commercial property or in residential property (including holiday homes).

You can invest in property in two ways:

- Directly – by buying a property as an investment.

- Indirectly – through a collective investment fund where your money is pooled with other people’s. Your money may be only invested in a range of properties or your money may also be invested in other assets, like cash, shares or bonds.

Generally, you will need to have either a large sum of money or you will have to borrow to invest directly in property.

How do I earn money from investing in property?

You can earn money by investing in property through:

- rental income

- capital growth if the value of the property rises

How and where do I invest property?

Top Tip

Make sure the provider you choose is regulated by the Central Bank of Ireland. Check here.

If you are considering investing in property directly, start by seeking independent financial and legal advice.

If you are considering investing in property indirectly through a collective investment fund, start by talking to:

- a financial adviser

- an investment broker

- an investment firm

Is investing in property right for me?

Click here for a list of questions to ask your adviser and things to consider before investing in property.

Pros and cons of investing in property

The pros and cons can vary depending on whether you invest directly or indirectly in a property fund.

Pros

- potential income from rent and capital growth if the property value increases

- good long-term growth potential

- generally, less volatile than other investments such as shares

Cons

- not a quick process to sell if you need access to your money

- affected by interest rate and market changes

- maintenance and insurance costs can be high if you invest directly in property

Is my money protected? Am I covered under the Investor Compensation Scheme or the Deposit Guarantee Scheme?

If you invest indirectly in property through a collective investment fund, part of your investment could be covered under the Investment Compensation Scheme (ICS). The ICS only pays compensation in specific circumstances and you’re not guaranteed to get compensation for all losses. Read more here and see if you would be eligible to make a claim.

Unit-linked funds

What are unit-linked funds?

A unit-linked fund is a pooled investment that allows you to combine your money with that of other investors. Fund managers will then invest this money in underlying assets in line with the objectives of the fund. A pooled investment allows you to invest in a wider range of investments than might be possible if you were investing as an individual.

How do I earn money from investing in unit-linked funds?

You will share any gains or losses of the fund with the other investors. Your policy documents will show which funds you have bought into and how many units you have been issued in each fund.

How and where do I invest in unit- linked funds?

You can invest in unit-linked funds through:

- a life insurance company

- a bank

- an investment broker

- a financial adviser

Pros and cons of investing in unit-linked funds

Pros

- potential diversification within your portfolio

- potential for lower costs and fees as a result of money being pooled together

- less work for you as the fund is managed by the financial provider

- Professional Investment Managers make decisions around investment strategy

Cons

- less control over your investment portfolio

- investment managers make decisions around the investment strategy

- fees and charges associated with the management of the fund

- as with all investments, performance is not guaranteed

Is my money protected? Am I covered under the Investor Compensation Scheme or the Deposit Guarantee Scheme?

Unit-linked funds are covered under the Investment Compensation Scheme (ICS). The ICS only pays compensation in specific circumstances and you’re not guaranteed to get compensation for all losses. Read more here and see if you would be eligible to make a claim.

Structured products

What are structured products?

Structured products are a type of fixed-term investment where you put your money away for a set period of time, such as between three and 10 years. Structured products are pre-packaged by an investment company and can offer a choice of investments across a wide range of asset types (e.g. deposits, property, equities, bonds or alternative classes like gold, copper etc.). These products can be either fully or partially capital protected, or may be described as having conditional capital protection – these are capital at risk products which means you could lose some or all of the money you have invested.

The retail investment market is changing rapidly, with a shift away from traditional capital protected products to more complex capital at risk products.

As the complexity increases, it becomes more difficult to understand the product. It also means there is a greater risk you could lose some or all of your money.

Top Tip

Some structured products may be advertised as ‘capital protected’, but this may not mean 100% of the money you invest is protected. The level of protection can vary depending on the product. Consider getting financial advice if you are choosing to invest in a structured product.

Types of structured products

All structured products are fixed-term investments meaning that you may have no access to the money you have invested for a number of years. It is also important to remember that you may lose some or all of the money you have invested if you try to get your money back before the end of the agreed fixed term.

Structured products can be categorised into a number of groups based on the level and type of capital protection available:

Conditional capital protection

Some structured products are described as having ‘Conditional Capital Protection’. This is also referred to as ‘soft’ capital protection. It is important to note that these types of products are ‘capital at risk’ products and your total investment may be lost.

An example of this type of product is a ‘Kick-Out Bond’. It is referred to as a ‘Kick-Out’, as the product may mature early and kick you out before the maturity date, with whatever payments or bonuses due, if the product has performed positively and met certain conditions.

The ‘conditional’ element typically means that your capital invested will be returned on the ‘condition’ that the product performance does not drop below a certain agreed level. The ‘conditional protection’ feature may allow the price to drop by a certain amount by the maturity date, and the full capital will still be returned to you – however this is on the condition that the price does not drop below the agreed level. If the price does drop below the agreed level at the maturity date then your full investment is at risk.

Example: if you invest €1,000 for five years in a ‘conditional capital protected’ structured product, and the ‘conditional protection’ level is set at 50% of the starting price:

- if the product performs well: If the structured product performs well and the value is higher at the end of the five years, you may get your original investment of €1,000 back plus an extra bonus of for example 20% – so a total of €1,200. You may also be ‘kicked-out’ early, with the bonuses/coupon payments, if the performance has met certain conditions.

- if there is no movement: If the structured product is at the same level at the end of the five years that it was when you originally invested, then you may only get your original investment back of €1,000 and nothing more.

- if the product performs poorly: If, at maturity, the structured product falls to 51% of its starting price (i.e. still above the 50% ‘level), you will still get back the €1,000 you invested due to the ‘Conditional Capital Protection’ feature.

However, if at maturity the price has dropped below the agreed 50% level, e.g. to 49% of its initial price, then you will only receive 49% (€490) of your capital back. So, in this example you would suffer a loss of €510, or 51% of your original investment.

Partial protection

This means that you are not guaranteed to get back all the money you invested, however a ‘partial’ amount is protected from loss. The amount you get back depends on how the structured product performed and only a proportion – say 90% – might be protected by the ‘capital guarantee’. These are also known as ‘capital at risk’ products. So, if the product performs poorly, in this example 10% of your original investment is at risk.

Full protection

These can also be described as ‘100% capital protected’, or having ‘capital security’ or a ‘capital guarantee’. These products may also be described as having ‘hard’ capital protection. This means that when your investment matures you will get back, at least, the money you have invested, regardless of performance. So, if you invest €1,000 you will get back at least €1,000. 100% capital protected structured retail products have become less common in Ireland over the last number of years.

Did you know?

If the financial institution is not in a position to repay your investment for example, they go out of business it is important to check to see if any element of your structured retail product is covered under the Deposit Guarantee Scheme. In addition, you should also see if you are covered under the Investor Compensation Scheme.

What do I need to do know before purchasing a structured product?

Structured products can be complex and there is a risk you can lose some or all of your money. Before investing, make sure you:

- get financial advice from a qualified and regulated financial advisor to see if the product is suitable for you.

- understand the main features of the product You should be provided with a key information document (KID) (see below) which will provide you with this information.

- make sure you are happy with the level of capital protection you have, for example conditional capital protection, partial capital protection or full capital protection.

- know how long your money is locked away for. Can you afford to not have access to your money for that amount of time?

- know whether you can access your money before the maturity date, if required?

- understand your risk profile (that is how much risk you want to take on). Your financial advisor can help you understand this by asking you a number of questions around risk.

- match your own risk profile to that of the structured product you are investing in using the Summary Risk Indicator (SRI). Each product will have an SRI contained in the KID – so this should match to your own risk profile.

- consider the Product Performance examples set out in in the KID, particularly those which highlight the performance in ‘unfavourable’ or ‘stressed’ scenarios.

- understand that the past performance of the structured product may not be the same as the future performance. Where marketing materials have examples of positive past performance, carefully consider this in addition with other relevant information. Which includes the SRI score, any capital at risk or other warnings within the product brochure, and the performance examples/scenarios within the KID.

What is the Key Information Document?

The Key Information Document (KID) is an important document that must be provided to you prior to investing in the structured product. The KID is designed to help you to understand the risks, costs, potential gains and losses in a product. It compares products from different providers in a standardised format. The KID should be provided in addition to any marketing materials or brochures.

KIDs should include the following information:

- the name of the product and the provider

- the types of investors the product is aimed at

- the risk and reward profile of the product, which includes the possible maximum amount of capital you could lose from the investment, the performance examples/scenarios of the product etc.

- the costs of investing in the product. The charges you pay are for the cost of running the fund for example you may have to pay an entry and exit charge.

- information about how and where you can make a complaint in case there is a problem with the product or the person producing, advising on or selling the product.

The KID is an important document and it is important to consider this information in addition to the investment firm’s product brochure.

Summary Risk Indicator (SRI): This risk scale gives the product a score from 1 to 7. The SRI is a guide to the level of risk of the product compared to other products. The higher the SRI score, the higher the risk of the product, with 7 being the highest level of risk and 1 being the lowest.

Performance scenarios/examples: The KID sets out four performance scenarios in a table to illustrate how your investment could perform under different situations. It shows the money you could get back in different market conditions. For example, the table will show stressed, unfavourable, moderate and favourable scenarios and will estimate the return you may receive in each scenario, including any loss of capital you have invested.

Are structured products regulated in Ireland?

Before investing in a structured product, check that the provider is regulated by the Central Bank of Ireland. If the provider is regulated you will have more protections, including access to the Financial Services and Pensions Ombudsman.

Is my money protected if the provider cannot repay me?

The deposit element (the amount you originally invested) of a structured retail product may be protected by the Deposit Guarantee Scheme if the provider is unable to re-pay it, for example if they went out of business. However, you should review the specific product terms and conditions to see if it is capital protected and/or covered by the Deposit Guarantee Scheme. If the provider is not based in Ireland, you may be covered under the other country’s compensation scheme

Crowdfunding

What is crowdfunding?

Crowdfunding is a way for individuals or businesses to raise money for a project. The project is posted online and money is raised through a ‘crowd of people’ investing in it. This way of raising money avoids the need for a bank loan. If you invest in crowdfunding, you may make a return or other reward. However, this is not guaranteed. Investing this way can be risky, so before investing, make sure you can afford to potentially lose the amount you invest.

Did you know?

If you invest in a crowdfunding platform you will not be covered by the Deposit Guarantee Scheme or the Investor Compensation Scheme and you may lose all your money.

Types of crowdfunding

The most common types of crowdfunding include:

- The lending-based model where you lend money to a business, in return for repayment of the loan and interest on your investment; this is also known as peer-to-peer lending and is the most popular type of crowdfunding in Ireland.

- The equity-based model where you invest in a business in return for a share of the profits or revenue generated.

- The donations or rewards-based model. Donation-based crowdfunding is generally used as a way to raise money for charitable causes. You will not make any return on this. With rewards-based crowdfunding you provide money to a business or project for a non-monetary reward. For example, if you invest in a new business idea you may receive the product for free when it is made.

Regulation of crowdfunding in Ireland

Crowdfunding Service Providers, who provide the platform to bring investors and consumers together, are the subject of new legislation which came into effect on 10 November 2021 which requires crowdfunding service providers to be authorised by the Central Bank of Ireland. This means that existing Crowdfunding Service Providers in Ireland can continue to provide their services until the earlier of:

- 10 November 2023 or

- The date that they are authorised under the new legislation

New businesses who want to provide crowdfunding services in Ireland must first be authorised by the Central Bank of Ireland under the new legislation before they can operate.

All authorised Crowdfunding Service Providers must display a prominent warning message on all advertisements that investment in crowdfunding projects entails risks, including the risk of partial or entire loss of the money invested, and that any investment is not covered by a Deposit Guarantee Scheme or by the Investor Compensation Scheme.

If the Crowdfunding Service Provider is regulated then you will have access to the Financial Services and Pensions Ombudsman if you have a complaint.

Cryptocurrency

What is cryptocurrency?

Cryptocurrency is digital money that can be exchanged in a similar way to normal currency, but there are no physical notes or coins, only digital records of transactions that exist on a computer. Cryptocurrencies use a ‘blockchain’, a shared public record of transactions, to create and track transactions. Cryptocurrencies are stored in a piece of software called a wallet.

What is a crypto (Blockchain) wallet?

A cryptocurrency wallet is used to store and manage different types of cryptocurrencies. The currencies themselves are stored on the blockchain and this wallet creates a secure portal to access your funds, similar to logging into your online banking. These wallets can be accessed through your browser or an app on your phone. At all times your funds are stored on the blockchain, not in the wallet itself.

How does the wallet work?

When you create your wallet there are three pieces of information that you need to be aware of:

Public key: The public key is the address of your wallet. Much like an email address which allows people to send you emails, the public key allows people to send cryptocurrency to you.

Private key: The private key can be considered your password that ensures access to the wallet so that you can spend or send your cryptocurrency to other addresses.

Seed phrase: The seed phrase is a critical feature and must be carefully secured. It is a randomly created mnemonic phrase of 12-24 words. The seed phrase is used to restore access to the blockchain through your wallet. For example, imagine you lose the phone that your crypto wallet is on. You buy a new phone. After installing the crypto wallet software on this new phone, you will need to enter your seed phrase to log in and to sync the wallet with the blockchain and get access to your funds. If you lose your seed phrase you will not be able to access your crypto-currency funds.

Types of cryptocurrencies

Bitcoin is one of the most widely-known cryptocurrencies. Other popular cryptocurrencies include Ethereum and Litecoin. They can be used to buy goods and services from people and businesses that accept cryptocurrencies. You can also convert your cryptocurrency into standard currency for everyday uses, using a cryptocurrency exchange.

In recent years, some cryptocurrencies, in particular Bitcoin, have gained a lot of media attention due to their increase in value, resulting in them becoming an attractive and popular investment for Irish consumers. However, cryptocurrencies can also be very unpredictable and their value can move up and down very sharply. As they are very complex, if you are considering investing in cryptocurrencies, make sure you know how to buy, sell and store them properly – or you could risk losing your entire investment.

Regulation of cryptocurrencies in Ireland

As cryptocurrencies are not a centralised currency and are not issued by the Central Bank of Ireland, they are not regulated in Ireland. Therefore, if you invest in cryptocurrencies, you will not be covered under the Deposit Guarantee Scheme or the Investor Compensation Scheme and you could potentially lose the amount you invested.

Cryptocurrency scams

The most common cryptocurrency scams to be aware of are:

Exchange hacks

This happens when scammers steal email addresses and passwords allowing them to log into your account and remove funds. Consider adding two-factor authentication or authenticator apps to your account to increase your level of security.

Wallet hacks

This happens when scammers get your login seed phrase. This is usually done through gaining access to your saved documents on your laptop, emails or cloud storage services. Never share your seed phrase with anyone under any circumstances and ensure any online service used to store the phrase is fully secured.

Social media scams

This happens when scammers create fake social media accounts, for example of a famous person, and ask their followers to take part in giveaway scams for free cryptocurrency. Any funds sent to the scammer’s wallet will be lost.

Social engineering scams

Social engineering scams are where scammers get vital information relating to user accounts. One way they do this is by phishing – this is where hackers send emails to user accounts linking them to fake websites (which look like official websites) and ask for important details, such as bank account information and other personal details.

Binary options

What are binary options?

Binary options are a form of fixed-odds betting. Typically, a trade involves predicting whether an event will happen or not (for example, if the price of a particular share or asset will go up) and the result is either yes or no. If you are correct, you ‘win’ and should see a return on your investment; if you are wrong, you lose your full investment.

Warning

The sale, marketing and distribution of binary options by firms to non-professional investors has been banned in Ireland and across Europe.

If you are contacted by a firm offering these, it may be a scam.

Top tip

Read the Central Bank of Ireland’s warning to consumers about the risks of investing in cryptocurrencies here.

Concerns about binary option trading

Investing in binary options can lead to significant losses. A key risk of the product is the fact that they are typically priced in a similar manner to fixed-odds bets, since their value is determined by the probability of an event happening. You are generally offered higher returns for lower probability events and lower returns for higher probability events. To make a profit from trading you need to ‘beat the odds’ on a regular basis, which, in the majority of cases, does not happen.

Warning

The sale, marketing and distribution of binary options by firms to non-professional investors has been banned in Ireland and across Europe.

If you are contacted by a firm offering these, it may be a scam.

Regulation of binary options in Ireland

The European Securities and Markets Authority (ESMA) banned firms from selling binary options to investors who are not professional investors across the EU, including Ireland. This ban came into effect on 2 July 2018 and was in place until 1 July 2019. The ban was removed by ESMA when they deemed that most national competent authorities (NCAs) had taken permanent national product intervention measures relating to binary options that are at least as stringent as ESMA’s measures.

Contracts for Difference

What is a Contract for Difference?

A Contract for Difference (CFD) is a contract you make with the seller of the CFD (usually an investment firm) to exchange the difference in the price of a particular asset (e.g. a share price), from the time you enter the contract to when the contract ends. You exchange the difference in the opening price and the closing price of the asset.

By investing in CFDs you are betting on the short-term movement of assets. If the asset price increases, you make money. If the asset price decreases, you lose money.

What makes CFDs different to other investments is that you never own the asset.

Top tip

The Central Bank of Ireland has issued a warning about CFDs and restrictions have been placed on the marketing, distribution and sale of CFDs to non-professional investors across Europe. Read more here.

Concerns about CFD trading

CFDs are complex products that are difficult to understand. Generally, the buying and selling of CFDs is not accompanied by investment advice, meaning you are responsible for your own trading decisions. However, if the investment firm is authorised, the Central Bank of Ireland must check if CFDs are appropriate for you and that you understand the risks. Many firms offering CFDs are not regulated. Investing in CFDs can lead to significant losses and you could end up losing more than the original amount invested.

Regulation of CFDs in Ireland

The European Securities and Markets Authority (ESMA) has restricted the buying and selling of CFDs to consumers who are not professional investors across the EU, including Ireland.

CFD scams

Saving & investing

How can you teach your kids to be good with money?

How should I invest for my children's future?

How do I start saving for a mortgage?

Is now a good time to buy Bitcoin?

How much should I have in my emergency fund?

At the Money Clinic, one guest asked Eoin how to start saving for a mortgage. You can find out the best ways to start saving in our Money Hub.

Are you considering investing in crypto? Read more about what crypto is and learn about the risks involved. Your kids may be getting older and you’d like to put some money away for them, read about the investing options open to you.

Money Hub

- Scams

- Pensions

- Investing

- Cross-border useful links

- Banking

- Mortgages

- Saving

- Credit cards

- Jargon buster

- Loans

- Debt

- Budgeting

- Crypto

- Getting financial advice

- Insurance

- Mortgage protection insurance

- Car insurance

- Payment protection insurance

- Travel insurance

- Getting insurance quotes

- Income protection insurance

- Whole of life insurance

- Serious illness insurance

- Pet insurance

- Making an insurance claim

- Home insurance

- Term life insurance

- Health insurance

- Gadget insurance