Personal Contract Plans (PCPs)

Many car dealers offer Personal Contract Plans (PCPs) as a way to pay for a car. PCPs can appear very attractive because they usually have low monthly repayments. However, PCPs are very complex compared to other types of car finance and it’s important to understand all the terms and conditions before you sign up.

A PCP is a particular type of finance which is similar to a standard Hire Purchase (HP) agreement. Many of the legal rules that apply to HP also apply to PCPs. However, the major difference is that you pay less of the amount owed during a PCP agreement, meaning you will still owe a considerable amount at the end of a PCP agreement.

Undercover Dealer – Personal Contract Plans

This video explains how personal contract plans work when buying a car

Please accept functional cookies to watch this video.

How a PCP works

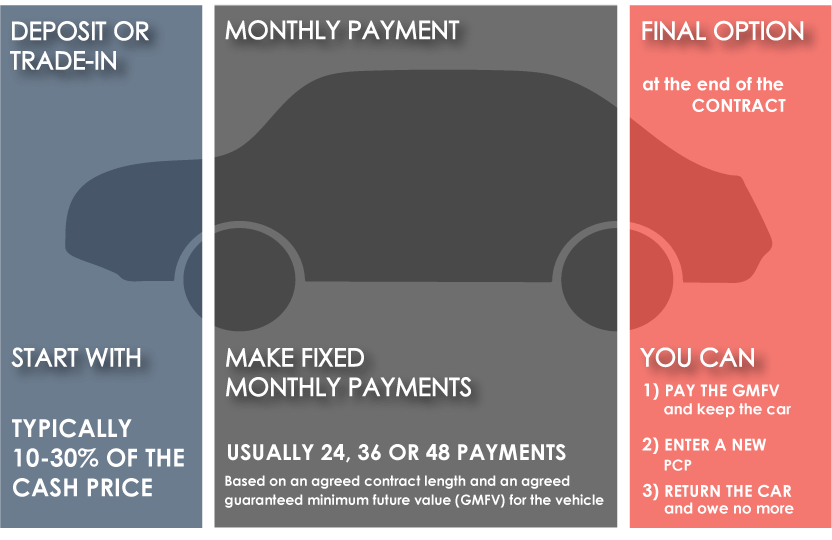

There are three parts to a PCP

- The deposit:

This is typically between 10% and 30% of the value of the car. Your deposit can be paid in cash or, if you already own a car, you can trade it in as your deposit. - Monthly repayments:

PCPs generally last for three years and they can have low monthly repayments. This can make them seem more affordable compared to other forms of finance. The reason the monthly repayments are low is because a large portion of the cost of the car is not paid until the end of the agreement. - Final balloon payment

This large, final payment is how much it will cost you to own the car at the end of the agreement. This figure is set at the beginning of the agreement by the finance company.

PCPs are among the least flexible forms of car finance. Because the repayments are fixed for the term of the agreement, you can’t usually increase your repayments each month if you want to and if you want to extend the term, you may be charged a rescheduling fee. There may also be other limitations, such as not going over a certain mileage limit, and commitments around wear and tear and servicing the car that you must agree to.

As with other types of credit, when you take out a PCP, your finance company will send details of the repayments you make to a credit reference agency. Find out more about what information is shown in your credit history.

What to consider before signing up

There are several things you should consider before signing up for a PCP. Most importantly, you should make sure that you fully understand how a PCP works and have worked out the total cost. You should also consider:

- What are the mileage limits and what are the penalties if you go over them?

- What are the rules around making modifications to the car?

- Are there rules around servicing the car?

- Are there rules around what type of insurance you need to take out? For example, is comprehensive insurance required.

- At the end of the agreement, will you be able to pay the final payment or have enough money saved for a deposit for a new PCP?

Problems making repayments

If you have problems making repayments on a PCP agreement, there are options available to you, including returning the car under the half rule.

To learn more about these options, see our information on problems making car repayments.

What happens if your car is faulty?

When you buy goods, including cars from a car dealer, you have consumer rights. If you buy a car on PCP and find a fault, the finance company to whom you are making your monthly repayments are responsible for fixing the issue as they are the legal owners of the car. As a practical first step, you can return to the dealer you bought the car from and ask them to fix it.

If the finance company will not help you resolve the issue you can go through their complaints process and if necessary escalate it to the Financial Services and Pensions Ombudsman.

What happens at the end of a PCP

At the end of your agreement you can:

- Pay the final balloon payment and own the car.

Until you make this final payment you don’t own the car – the finance company does. This means that for the duration of the agreement, you are only hiring the car. If you want to own the car, you will need to think about how you plan to pay the balloon payment long before your agreement ends. Unless you’ve been saving for this lump-sum payment, it may mean having to take out a personal loan to pay for it. - Hand the car back.

Be aware that if you hand the car back, while you generally don’t have to pay the car dealer anything more, you might have to pay a penalty if you haven’t met all the terms and conditions. For example, if you have exceeded any mileage limits or if there’s excessive ‘wear and tear’ on the car. In addition, if there is any equity in the car this will not be refunded to you. For example, if the final payment is €10,000 but the car is worth €12,000, you will not be given a refund of €2,000. - Enter into another PCP agreement.

The deposit you put down for your first car won’t be given back to you. If your car is worth more than the final payment then you may have some equity to put towards a deposit on a new car. For example, if the final payment is €10,000 but the car is worth €12,000, you will have €2,000 to use as a deposit for your next car. The value of the car will depend on its condition and the second hand car market.

What happens if the car is worth less than the final payment?

If the value of second-hand cars has fallen and/or your car is in poor condition, then you may not have any equity in the car at the end of the agreement. If you have no equity to use as a deposit on your next car, you will need to fund it another way. Or, if you want to pay the final payment and own the car, you might find you are paying more than the car is worth.

What happens if your mileage is higher than what was agreed?

At the end of your agreement, if you want to return the car and walk away or enter a new PCP, mileage becomes important.

If you are giving the car back and you have exceeded the mileage limit, you may have to pay a financial penalty. If you are entering into a new PCP, and you’ve exceeded the mileage limit, this will affect the amount of equity you have to use as a deposit for your next PCP.

Money Hub

- Scams

- Pensions

- Investing

- Cross-border useful links

- Banking

- Mortgages

- Saving

- Credit cards

- Jargon buster

- Loans

- Debt

- Budgeting

- Crypto

- Getting financial advice

- Insurance

- Mortgage protection insurance

- Car insurance

- Payment protection insurance

- Travel insurance

- Getting insurance quotes

- Income protection insurance

- Whole of life insurance

- Serious illness insurance

- Pet insurance

- Making an insurance claim

- Home insurance

- Term life insurance

- Health insurance

- Gadget insurance